Description

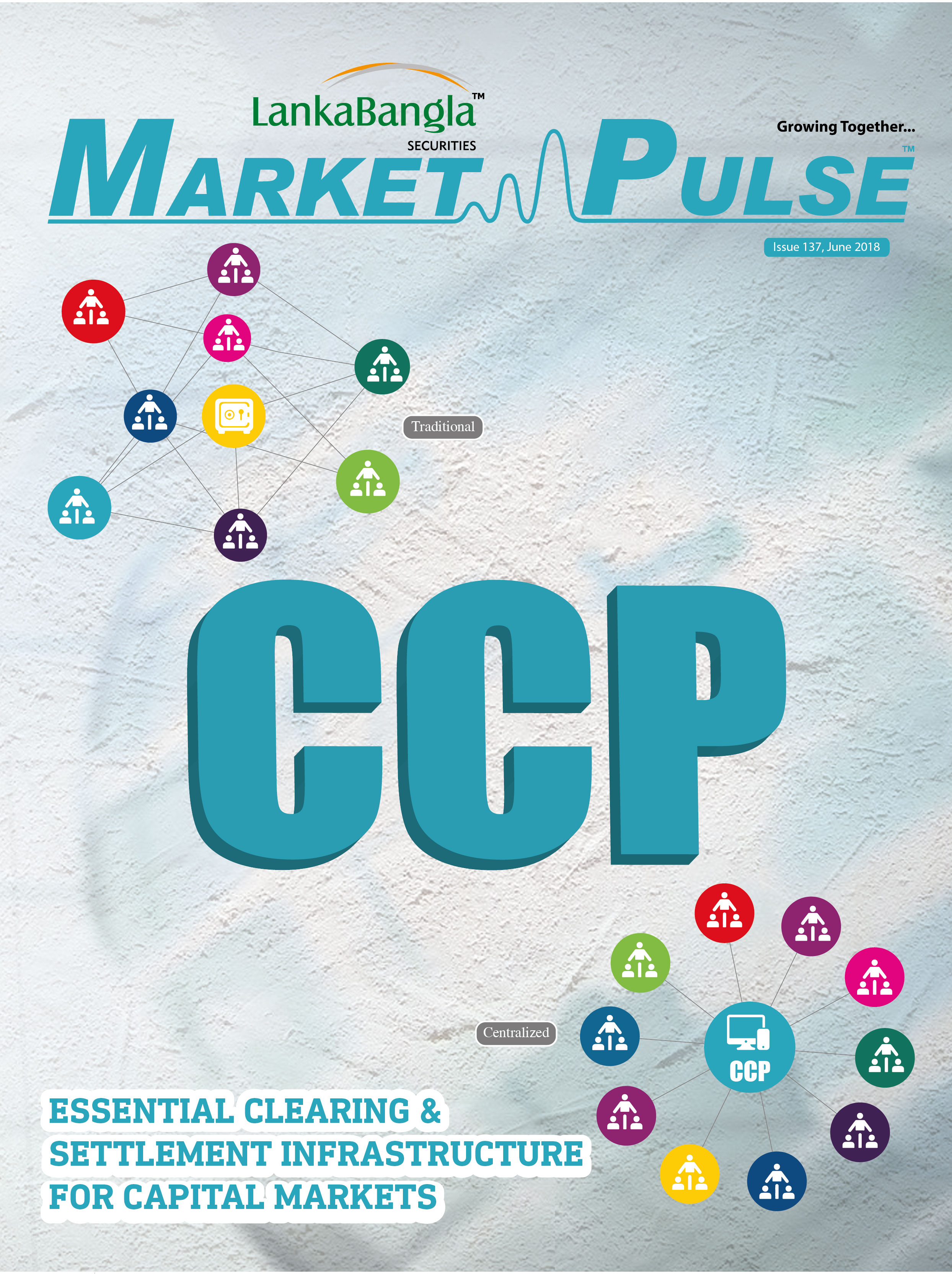

The shift to central clearing is a key element of financial system reforms in the aftermath of the Great Financial Crisis. To reduce the systemic risks resulting from bilateral trading, the G20 Leaders agreed at the 2009 Pittsburgh Summit that all standardized derivatives contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties (CCPs). CCPs had, indeed, proved resilient during the crisis, continuing to clear contracts even when bilateral markets had dried up. Since then, central clearing has evolved. The share of centrally cleared transactions has increased significantly; CCPs have expanded; the industry has remained highly concentrated; and the range of banks and other financial institutions that channel their transactions through CCPs has broadened. As a consequence, more and more connections in the global financial system run through CCPs. However, the concept is still new to the Bangladesh market and is on its path of initiation.